For the full directory of reasons your eCheck money is generally kept, read our deposit agreement. Remark the details of your take a look at once posting the pictures and you can ensure that the data is right. While the financing are prepared for you to availableness, you’ll understand the put shown on your own available equilibrium. Dumps produced on the a saturday otherwise Week-end will also be available the next Saturday. Places produced for the a national getaway tend to achieve your account on the the afternoon after your bank account are credited. In case your holiday falls to the a saturday, including, your finances was available on Wednesday.

- Once you see unauthorized charge or believe your bank account is affected e mail us immediately in order to statement con.

- Cellular deposit is a straightforward, smoother, and you can safer means to fix deposit inspections in the family savings instead of being forced to go to a lender department in person.

- If you’re also signed in to your own lender’s cellular app, just be capable view the deposit limitations.

- Be sure to confirm the place you want the funds deposited.

- Calls try limited by half-hour for each phone call, leaving out the fresh inmate’s attorney.

- ET, the initial $300 of one’s put will appear in your account next working day, and also the rest (up to $twenty five,000) might possibly be on another business day.

For many who’re not following legislation—finalizing it and creating some type of “to possess cellular deposit just” on the back—next truth be told there’s a go the newest put might possibly be refused. You’d need redeposit the newest view, that can increase the wishing date until it clears the account. There are many reasons you may choose to make use of your bank’s mobile view deposit feature, starting with convenience. Placing inspections utilizing your smart phone is generally much more obtainable and you can less time-sipping than simply riding in order to a department or Atm.

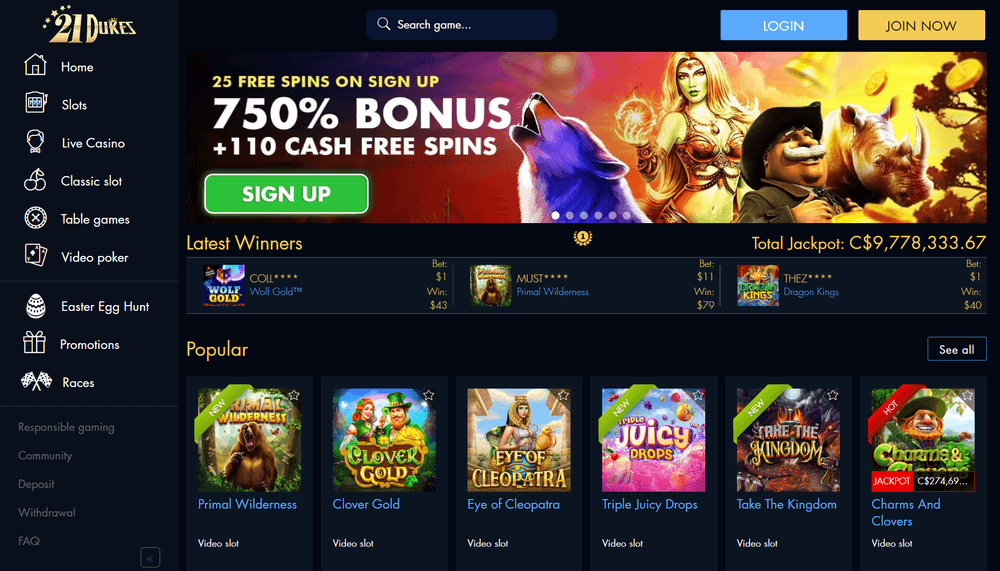

Boku casino bonus – Save up so you can fifty% over the cost of assemble calls!

To possess records on the Friend Purchase Ties see FINRA’s BrokerCheck. Advisory functions considering because of Ally Invest Advisors Inc., a registered investment adviser. Ally Purchase Advisors and you will boku casino bonus Friend Purchase Ties is actually entirely possessed subsidiaries from Friend Monetary Inc. Ties products are Not FDIC Covered, Maybe not Financial Secured that will Eliminate Well worth. Sure, you may use Friend eCheck Put to fund a new Certificate away from Put (CD).

Then it favorable to help you referring to ATMs, which can ruin checks. You will discover a message verification once a cellular Put has started filed. Another email address might possibly be produced if put might have been assessed to let you know the newest condition of one’s deposit. An endorsement current email address cannot make sure the money are available instantaneously. When we discovered your own cellular deposit by our very own Mobile Deposit slashed-off time away from 8pm CST, Tuesday because of Monday (leaving out getaways), i imagine you to working day as your day of your put. If you don’t, we are going to consider your put was developed to the 2nd working day we have been discover.

Our very own finest demanded spend from the mobile phone costs casinos in the us

- Fill in your own consider and watch for verification to see if it is approved.

- Bonds goods are Not FDIC Covered, Maybe not Lender Secured and may Remove Well worth.

- To have background to the Friend Invest Securities visit FINRA’s BrokerCheck.

- Nations provides hyperlinks to help you YouTube or other other sites simply and you may strictly for your benefit.

It merely demands a phone number so zero identity theft and fraud can also be exist. Just be sure that your costs fits what you’re pregnant if your monthly bill happens. Put the money into your partner otherwise pal’s account and they have the new liberty to expend the money to your calls or other communications characteristics available at its studio.

For example, the original $two hundred of a deposit must be designed for bucks withdrawal or check-writing the following business day. Mobile banking basically gives you fast access to your money than ATMs. Because the that have Atm dumps, a great banker may have to recover monitors regarding the machine, up coming manually digitize him or her.

Currently an excellent Chase Customers

“End up being the extremely well-known and you will top standard bank helping the newest armed forces as well as their families.” Before you leave all of our site, we want one to know the software shop possesses its own confidentiality strategies and you can number of security which is often distinctive from ours, very please review their polices. Before leaving our webpages, we want one to know your application shop features its own confidentiality techniques and number of security which is often distinct from ours, thus please comment the formula. When we come back a product or service to you unpaid for any reason (such as, since the payment try averted otherwise there had been lack of fund to invest it) your concur not to ever redeposit you to definitely Product through the Provider. You agree to retain the Goods in the a safe and you may safer environment for starters month in the time out of deposit acknowledgement (“Retention Months”).

For every financial and borrowing from the bank connection have a spending budget availability policy. However, a financial can take a mobile consider deposit to own specific reasons, which means that your consider might take lengthened to clear. Mobile deposit is one of the ways banking is always changing. Using your lender’s mobile software along with your mobile phone’s camera, you might put a to your account rapidly, should you want. If your’re hectic juggling life, on the run on the next concert or just sitting on their chair on your own PJs, mobile put makes it possible to get paid on your own terminology. Most financial institutions involve some type of limitations to the everyday, weekly otherwise monthly deposits.

What to do with a check immediately after cellular deposit

For many who’re studying the look at, makes it detached out of your checkbook and all of four corners are obvious. Documents should be stored as the an excellent JPG (perhaps not a good PDF) and cannot meet or exceed step one MB. We have been handling all you need to learn about just how that it totally free, simple and secure function work.

You’re responsible for maintaining the fresh bodies capacity and you will connections needed to be used of your Solution. Wells Fargo advises storing a challenging duplicate of your look for 5 days. It may be enticing to place the newest look at into the fresh shredder, but that will result in issues in case your lender has a good matter regarding the deposit. If your count your get into differs from usually the one on the the new look at, we’ll automatically to improve extent to complement what exactly is to your look at. Discover this informative article on your membership’s earlier/recent transactions.

For those who have a smart device, then chances are you are able to use cellular view put, offered your own bank includes the brand new ability in cellular financial software. Whenever submission a check to own mobile put, you’ll have to endorse it by the finalizing your identity. Beneath your signature, you’ll must also make certain adaptation of your terms “to possess mobile put only,” according to exacltly what the financial or borrowing partnership demands. Banking laws wanted this article and, without it, your mobile consider put can be refused. Such as, it’s it is possible to to be focused which have a secluded deposit capture ripoff, where you’re requested to put a phony consider. The good news is, you might manage oneself against this sort of mobile put take a look at con from the just recognizing papers monitors away from somebody you realize and you may faith.